Os produtores europeus de produtos longos encontram-se em dificuldades financeiras. Na ausência de intervenção do governo em meio à queda duradoura do mercado, os produtores podem ser obrigados a fechar operações ou descarregar capacidades selecionadas. A confluência de pouca lucratividade e custos crescentes continua a exercer uma influência prejudicial na produção no sul e no norte da Europa.

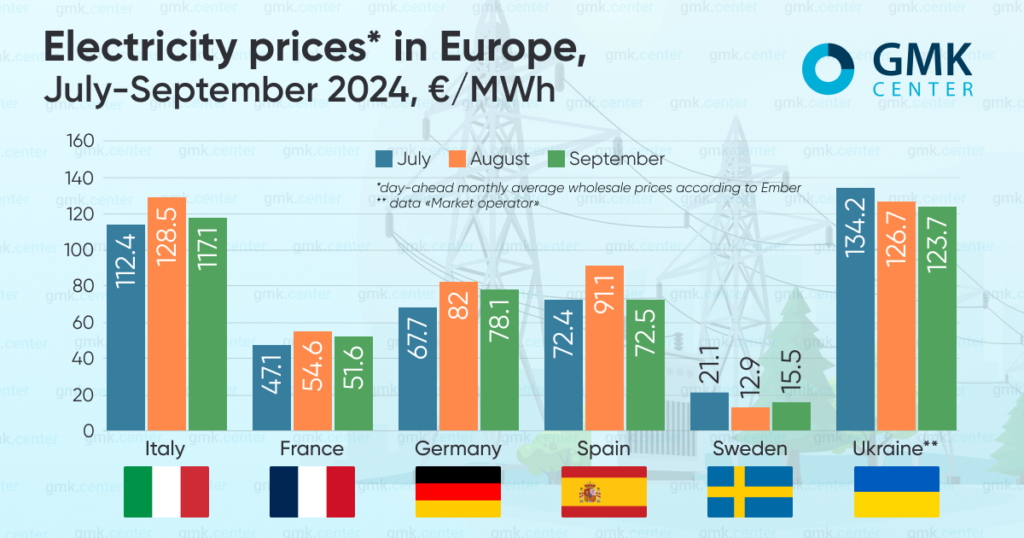

Os produtores de produtos longos estão sinalizando despesas exorbitantes com eletricidade e preços crescentes de sucata como grandes desafios. Para mitigar esses custos, eles estão adotando medidas como cortes de produção e turnos noturnos para economizar no consumo de eletricidade.

Uma fonte do mercado observou que os preços de venda vigentes para produtos longos são voláteis e resistentes a ajustes para cima. As vendas de fio-máquina e vergalhões estão diminuindo em toda a Europa, com ambas as categorias de produtos atualmente lutando. Notavelmente, a Alemanha está testemunhando um declínio persistente nos volumes de vendas e preços.

No sul da Europa, os produtores europeus de aço laminado estão contemplando as paradas de produção como uma estratégia de corte de custos para reduzir a aquisição de sucata.

Com os indicadores atuais falhando em sinalizar uma recuperação próxima, as projeções de mercado apontam para 2025 refletindo os desafios do ano atual, embora com algumas modificações. No entanto, um ressurgimento da demanda é esperado na segunda metade do próximo ano.

Um produtor de produtos de longo prazo com operações abrangendo vários países europeus sugeriu um potencial declínio estrutural na trajetória de longo prazo do mercado.

O setor europeu de distribuição de aço também enfrenta pressões significativas. Os relatórios sugerem que vários centros de serviços em toda a Europa estão enfrentando dificuldades e podem enfrentar fechamentos.

Conforme destacado pelo Ronsco Center em outubro de 2024, o mercado global de vergalhões exibiu tendências de preços divergentes entre as regiões. A Turquia testemunhou aumentos de preços impulsionados pelo aumento dos custos de sucata e pela demanda doméstica estável, enquanto os EUA experimentaram uma queda nos preços atribuída à demanda moderada em meio a incertezas econômicas. Na Europa, a crescente concorrência dos produtos importados exerceu pressão sobre o mercado.